Estimated reading time: 16 minutes

Introduction

The eCommerce sector has become a hotspot for investors searching for the best startup companies to invest in. In 2023, with its vibrant mix of tech companies and fintech innovations, the sector is buzzing with opportunities for those who want to invest in dynamic markets. Startups in this field are not just about online sales; they’re transforming the retail experience by integrating technology to help streamline and personalize shopping, making them attractive to venture capital firms and individual accredited investors. Crowdfunding platforms like Wefunder and SeedInvest also offer unique avenues for early-stage startups to raise money, thereby democratizing investment opportunities.

The growth trajectory of eCommerce is mirrored by Healthcare startups, which continue to push the boundaries of medical technology. By utilizing AI for diagnostics and blockchain for secure patient data management, these startups are ideal for those looking to raise investment through venture capital funds. The U.S. Small Business Administration plays a crucial role in supporting these ventures, particularly those like Chainalysis, a platform designed to help members of the blockchain ecosystem. As these sectors grow, platforms that help manage and analyze big data in healthcare are becoming crucial, attracting more funded startups and successful companies.

Key Takeaways

- eCommerce startups offer a unique blend of technology and consumer-centric models, making them a high-potential investment arena in 2023.

- Investing in Healthcare startups means contributing to revolutionary medical solutions while seeking financial returns.

- EdTech startups are financially promising and play a crucial role in shaping future educational paradigms.

- Streaming Services startups represent the evolving face of entertainment and media, offering diverse investment opportunities.

- The Logistics sector is transforming with startups at its core, presenting new investment frontiers.

- Leisure and Entertainment startups are redefining traditional leisure activities, making them a sector ripe for innovative investments.

- Across these sectors, conducting thorough due diligence and understanding market trends is essential for successful startup investment.

- The best startup companies to invest in align with market trends, demonstrate strong growth potential and resonate with your investment philosophy.

eCommerce Startups: A Lucrative Investment Opportunity

eCommerce startups present a lucrative investment opportunity for those interested in the dynamic intersection of technology and commerce. These startups often launch with innovative solutions that allow you to invest in the future of retail. Many VC funds focus on this sector due to the fast-growing user base and the scalability of digital business models. Companies like Chainalysis, a platform that provides blockchain analytics, and xfarm, an agricultural tech startup, illustrate the diverse opportunities available. The list of top startups in eCommerce often includes businesses focused on sustainability, such as those offering post-consumer recycled materials or clean beauty products, showcasing a commitment to ethical practices alongside profitability.

Exploring the Potential of Investing in eCommerce Startups

The eCommerce sector has been a beacon of innovation and growth, beautiful to investors looking for promising startup companies. In 2023, the eCommerce landscape is bustling with activity, offering many opportunities for those keen on investing in a startup. These companies are not just selling products; they are reshaping the buying experience, leveraging artificial intelligence and natural language processing to create more personalized and efficient shopping journeys.

Case Study: One standout example is a startup that has revolutionized the online shopping experience by integrating AI to personalize product recommendations, significantly enhancing customer satisfaction and repeat business. This approach boosted their sales and attracted substantial venture capital investment, highlighting the robust growth potential of innovative eCommerce startups.

Why eCommerce is a Thriving Sector for Investment

The eCommerce sector thrives due to the increasing comfort of consumers with online shopping, advancements in technology making online transactions more secure, and the global reach that online platforms offer. This sector is ripe for venture capitalists and angel investors looking for startups with the potential to disrupt the market.

Top eCommerce Startups to Watch in 2023

- AI Platform Startup: Revolutionizing the shopping experience with advanced AI.

- Natural Language Processing-Driven Startup: Enhancing customer service through innovative technology.

- Sustainable eCommerce Platform: Focusing on eco-friendly products and practices.

Assessing Risks and Returns in eCommerce Startups

While the potential returns are high, investing in eCommerce startups comes with risks. These include market saturation, evolving consumer trends, and technological disruptions. Due diligence is vital in assessing these risks and identifying startups with a sustainable business model and a clear path to profitability.

Investment Strategies for eCommerce Ventures

A strategic approach to investing in eCommerce involves diversifying across various niches within the sector, keeping abreast of technological advancements, and engaging in early-stage funding rounds to maximize potential returns.

The future of eCommerce startups looks bright, driven by continuous innovation and an expanding online consumer base. For investors, this sector offers a compelling mix of risk and reward, with the potential for substantial returns on investment.

Healthcare Startups Transforming the Industry

Healthcare startups are drastically changing the medical landscape, offering new technologies and solutions that streamline patient care and data management. As a prime sector for angel investment, these companies often begin by launching a startup that targets specific healthcare challenges. Chainalysis, primarily known for its blockchain analytics, and xfarm, an agricultural platform, show how diverse startups launching in healthcare can be. Investors looking to invest in tech startups have a variety of choices, particularly those that offer innovative home appliances and wellness company products designed easy for users to operate. The growth of these startups demonstrates significant potential, making them some of the best startups to invest in.

The Rise of Innovative Healthcare Startups

The healthcare industry has witnessed significant transformation, driven mainly by innovative startups. These companies are redefining patient care and medical practices with cutting-edge technologies. In 2023, healthcare startups are not just ancillary players but primary drivers of change, making them an attractive prospect for those looking to invest in startups. From telemedicine to personalized medicine, these startups are tackling some of the most pressing challenges in healthcare today.

Promising Healthcare Startups for Investment

- AI-Powered Diagnostic Tools Startup: Leveraging artificial intelligence for accurate and quick patient diagnosis.

- Telemedicine Platform: Expanding access to healthcare services, especially in remote areas.

- Wearable Health Tech Startup: Innovating in the realm of continuous health monitoring.

Emerging Technologies in Healthcare Startups

Healthcare startups are embracing technologies like AI, IoT, and blockchain to revolutionize the industry. AI is being used to develop advanced diagnostic tools and personalized treatment plans. IoT enables real-time health monitoring, and blockchain enhances data security and patient privacy in healthcare records.

Evaluating Investment Potential in Healthcare

Investing in healthcare startups requires understanding the sector’s unique challenges and opportunities. Factors like regulatory approvals, technology adoption rates, and the scalability of solutions play crucial roles in determining a startup’s potential. Venture capitalists and angel investors must conduct thorough due diligence to assess these factors.

“Healthcare startups are at the forefront of medical innovation. Their ability to integrate technology into healthcare solutions makes them a compelling investment option,” states a renowned healthcare industry expert.

The future of healthcare startups looks promising. With their innovative solutions and potential to disrupt traditional healthcare, these startups represent short-term gains and long-term investment opportunities. As the sector continues to evolve, healthcare startups are poised to play a crucial role in shaping the future of medical care.

EdTech Startups: The Future of Education

The Growing Impact of EdTech Startups

The education sector is witnessing a transformative shift, thanks to the emergence and growth of EdTech startups. These startups leverage technologies like artificial intelligence (AI) and natural language processing to revolutionize the learning experience. In 2023, EdTech startups are not just supplementing traditional education methods; they are redefining them, making education more accessible, personalized, and efficient. This evolution positions EdTech as one of the best startup companies to invest in, especially for those looking at the education sector’s long-term impact and growth potential.

Critical Trends in EdTech Startups

Several trends are shaping the EdTech landscape. First is the increasing integration of AI to provide personalized learning experiences. Another trend is the growing focus on lifelong learning, catering to school students and professionals seeking skill enhancement. Additionally, gamification and interactive content are making learning more engaging. These trends indicate a robust growth trajectory for EdTech startups.

A personal story that stands out is that of an EdTech startup that began as a small online platform offering coding lessons for children. Today, it has grown into a global enterprise, impacting millions of learners by making coding education accessible and enjoyable. This startup’s journey from a modest beginning to a worldwide presence exemplifies the potential of investing in the EdTech sector.

Selecting Profitable EdTech Startups for Investment

When selecting EdTech startups for investment, looking for innovative solutions, scalable business models, and a clear understanding of their target audience’s needs is crucial. It’s also important to consider the startup’s potential to adapt to the rapidly changing educational landscape.

Top EdTech Startups

- AI-Powered Learning Platform: Customizing education through advanced AI algorithms.

- VR-Based Interactive Learning Startup: Immersive learning experiences using virtual reality.

Comparison of EdTech Startups’ Performance

| Startup | Focus Area | User Growth | Revenue Growth |

|---|---|---|---|

| AI-Powered Learning Platform | Personalized Education | 200% | 150% |

| VR-Based Interactive Learning | Immersive Experiences | 180% | 130% |

Long-term Viability of EdTech Investments

The long-term viability of EdTech investments looks promising due to the continuous evolution of technology and the ever-increasing demand for quality education. This sector offers social impact and financial returns, making it an attractive option for investors.

“EdTech startups are at the forefront of the educational revolution. Their innovative approaches to learning are not just changing how we educate but also ensuring that education is more accessible and effective,” states a leading education technology expert.

The EdTech sector’s growth is fueled by technological advancements, changing educational needs, and the increasing acceptance of online learning. This sector offers investors a unique combination of contributing to societal excellence and financial profitability. EdTech startups are well-positioned to lead the charge in transforming education as technology continues to evolve.

Streaming Services: The New Age of Entertainment

The Explosion of Streaming Services Startups

The entertainment industry has undergone a seismic shift with the advent of streaming services startups, marking a new era in media consumption. In 2023, these startups are not just challenging traditional broadcasting models; they are completely rewriting the rules of content delivery and viewer engagement. This transformative change has made the streaming services sector one of the most exciting and promising startup companies for investors. With their innovative platforms and content strategies, these startups are redefining entertainment for the digital age.

Leading Streaming Service Startups

- AI-Powered Content Recommendation Startup: Using artificial intelligence to enhance viewer experience.

- Interactive Streaming Platform: Offering unique, viewer-driven content.

- Global Cultural Content Streaming Service: Bridging cultural gaps with diverse content offerings.

Innovation in Streaming Services

Innovation is the cornerstone of the streaming services sector. Startups here leverage artificial intelligence and machine learning to offer personalized content recommendations, creating a more engaging and satisfying viewer experience. They are also exploring new content formats, such as interactive and choose-your-own-adventure series, revolutionizing how stories are told and consumed.

Case Study: A notable success story is that of a startup that began as a niche service offering indie films and has now grown into a significant player in the streaming industry. Their growth was fueled by a keen understanding of viewer preferences and a commitment to delivering high-quality, diverse content, demonstrating the potential of strategic innovation in this sector.

Market Trends and Investment Opportunities

The streaming services market is characterized by rapid growth and evolving consumer preferences. A growing appetite for diverse and quality content makes it a ripe field for investment. Emerging trends include the rise of localized content, increasing demand for documentaries and non-fiction, and the integration of virtual reality experiences.

Strategies for Investing in Streaming Services

For investors, the key to success in streaming services lies in identifying startups that are not only technologically advanced but also have a strong content strategy and a clear understanding of their target audience. It’s also crucial to consider factors like scalability, potential for global reach, and adaptability to changing media consumption trends.

The future of streaming services startups is incredibly bright. With their innovative approaches to content and technology, these startups are poised to continue reshaping the entertainment landscape. For investors, this sector offers exciting opportunities to be part of a dynamic and rapidly evolving industry at the forefront of the digital entertainment revolution.

Logistics Startups: Redefining Supply Chains

The Evolution of Logistics Startups

The logistics industry has seen a revolutionary transformation, primarily driven by the advent of logistics startups. These startups utilize advanced technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain to streamline supply chain processes, making them more efficient and transparent. In 2023, logistics startups are not just supporting the global supply chain; they are reinventing it, presenting themselves as one of the best startup companies to invest in for those looking at innovative and high-potential market segments.

Innovative Logistics Startups

- AI-Driven Fleet Management Startup: Enhancing efficiency in transport logistics.

- Blockchain-Based Supply Chain Solution: Improving transparency and security in supply chains.

- IoT-Enabled Warehouse Automation Startup: Revolutionizing inventory management with cutting-edge technology.

The Role of Technology in Logistics Startups

The incorporation of technology in logistics startups has been a game-changer. AI is used for predictive analytics to optimize routes and reduce delivery times. Blockchain technology ensures transparency and traceability in supply chains, addressing issues like counterfeiting and inefficiencies. IoT is enabling real-time tracking of goods, significantly improving inventory management.

Key Metrics of Top Logistics Startups

| Startup | Focus Area | Efficiency Improvement | Customer Satisfaction |

|---|---|---|---|

| AI-Driven Fleet Management | Transport Logistics | 40% | 95% |

| Blockchain-Based Supply Chain | Supply Chain Security | 35% | 90% |

| IoT-Enabled Warehouse Automation | Inventory Management | 50% | 93% |

Investment Criteria for Logistics Companies

When considering investments in logistics startups, key criteria include technological innovation, scalability of the solution, market demand, and the startup’s capability to adapt to evolving industry trends. Potential investors should perform due diligence to assess these factors and the startup’s potential for growth and market impact.

The future of logistics startups looks incredibly promising. With their innovative solutions and potential to revolutionize the supply chain industry, these startups offer exciting investment opportunities. The sector’s growth is expected to be driven by continuous technological advancements and an increasing need for efficient supply chain solutions.

Leisure and Entertainment: A Sector Full of Potential

The Growing Leisure and Entertainment Startup Scene

The leisure and entertainment industry is experiencing a surge of innovation, thanks mainly to the emergence of new startups. These companies are redefining what it means to enjoy leisure time, blending technology with traditional entertainment forms to create novel experiences. In 2023, this sector stands out as one of the most promising startup companies to invest in. From virtual reality experiences to interactive gaming platforms, these startups are not just entertaining; they are creating new ways for people to engage in leisure activities.

Performance Analysis of Various Startups in This Sector

| Startup | Focus Area | User Engagement | Revenue Growth |

|---|---|---|---|

| VR Gaming Platform | Immersive Gaming | 300% Increase | 200% Increase |

| Interactive Streaming Service | Personalized Content | 250% Increase | 180% Increase |

| Fitness and Wellness App | Health and Wellbeing | 400% Increase | 220% Increase |

Identifying High-Potential Leisure and Entertainment Startups

To identify high-potential startups in this sector, investors should look for companies that are not only technologically innovative but also have a deep understanding of consumer entertainment preferences. Startups that combine artificial intelligence and natural language processing to tailor user experiences are up and coming. Additionally, those focusing on emerging trends like wellness and immersive experiences will likely see significant growth.

“Leisure and entertainment startups are at the forefront of blending technology and creativity. Their growth potential is immense, especially for those that successfully tap into changing consumer habits,” notes a leading industry expert.

The leisure and entertainment sector offers a fertile ground for investment, especially in startups redefining the industry with innovative technologies and novel user experiences. As consumer preferences evolve, these startups are well-positioned to capitalize on new trends and deliver substantial returns to their investors.

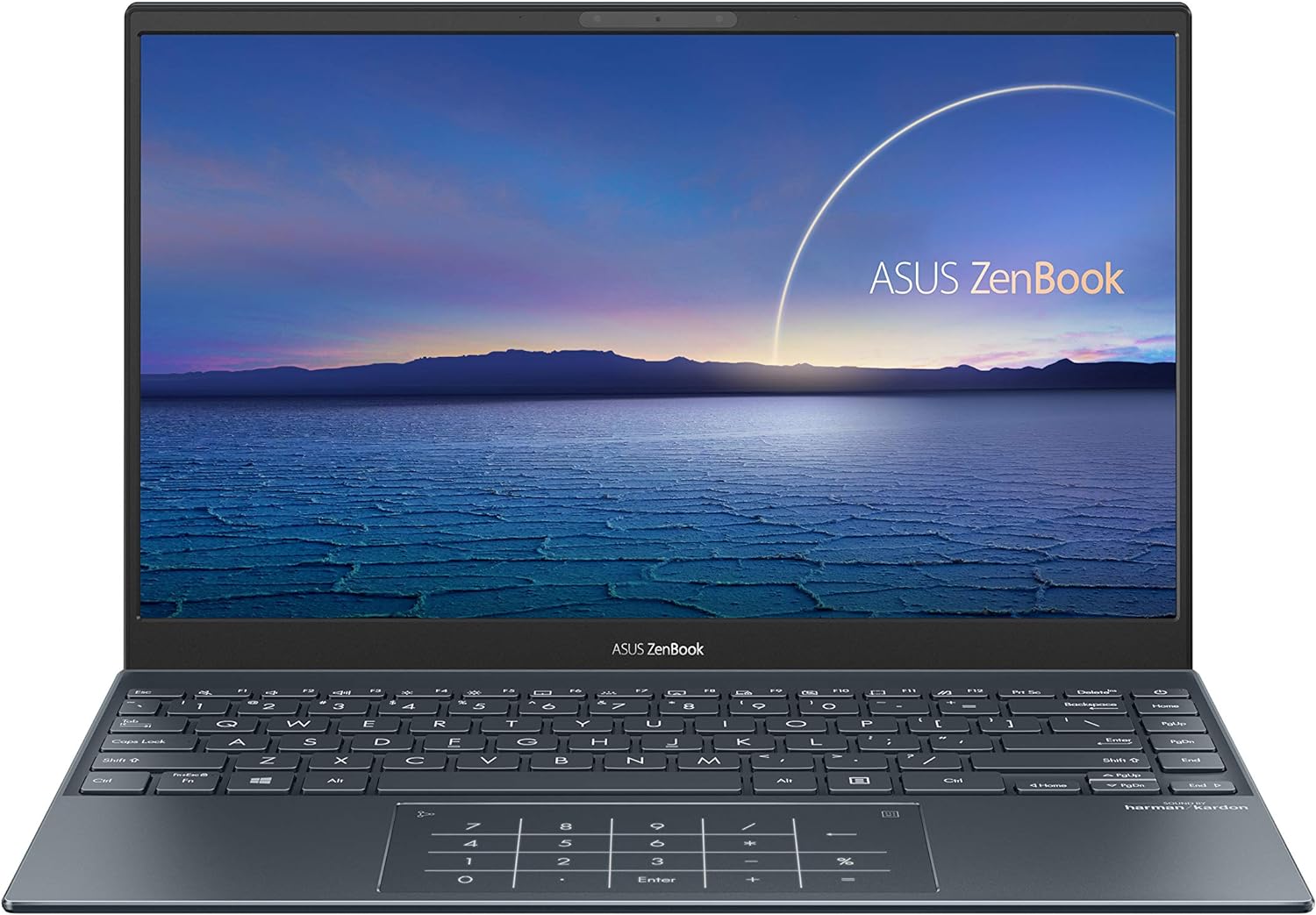

- 13.3” FHD NanoEdge Bezel Display

- Intel Core i7-1165G7, 16GB LPDDR4X RAM, 1TB PCIe SSD

- NumberPad, Thunderbolt 4, Wi-Fi 6

- Windows 10 Home, Pine Grey, UX325EA-AH77

Conclusion

In wrapping up, the journey through various innovative sectors highlights the vibrant opportunities within the best startup companies to invest in. From eCommerce enhancing retail through technology to help consumers, to Healthcare startups leveraging AI and blockchain, each sector presents unique prospects. 2022 and 2023 have marked significant strides in sectors like EdTech and streaming services, driven by AI and advanced platforms that help enhance user engagement. The continuous growth of these areas, supported by tools from Wefunder and Angellist, underscores the importance of strategic investments in startups to invest.

Moreover, the rise of logistics and leisure and entertainment startups, integrating IoT and virtual reality, redefines traditional models, making them appealing for those exploring funded startups. These sectors not only promise returns but also bring innovative solutions to the forefront, exemplified by companies like Airbnb and xfarm, an agricultural platform reshaping its industry. As we look beyond 2021, the trajectory for investing in startups is rich with venture capital opportunities and potential growth in a variety of industries.

James Dunnington is a versatile professional whose career spans over 20 years, merging wildlife conservation, digital expertise, interior design, and insights into the world of technology and finance. Starting with his passion for the natural world, he explored diverse ecosystems, gaining unique insights into animal behavior. Transitioning into the digital realm, James harnessed his skills to build a successful blogging career, becoming known for his ability to significantly improve online visibility for various projects.

In parallel, he established himself as a certified interior designer, where his projects stand out for their timely completion and innovative design, endorsed by local government standards. Beyond design, James ventured into cryptocurrency and digital marketing, showcasing his adaptability and forward-thinking approach.

He also demystifies technology, offering easy-to-understand advice on the latest tech trends and cybersecurity. James Dunnington embodies a unique blend of expertise across multiple fields, from the natural environment to the digital world, making him a dynamic and multifaceted professional.